6 Ways to Give Generously Without Touching Your Bank Account

Tax-savvy donors use other assets that are just as valuable to nonprofits as cash

The holiday season is almost here – and, if you’re like me, you want to support your favorite charities before we close the books on 2019.

The final month of the year is a critical time for most nonprofits. Roughly $3 of every $10 donated each year comes in December – and 10 percent is contributed during the last three days of the year.

But the holidays are also expensive. We’re buying gifts, planning trips to see friends and family, and hosting holiday dinners and parties.

So how do charities manage to raise so much money at a time when many of their donors are stretched thin?

It’s not magic.

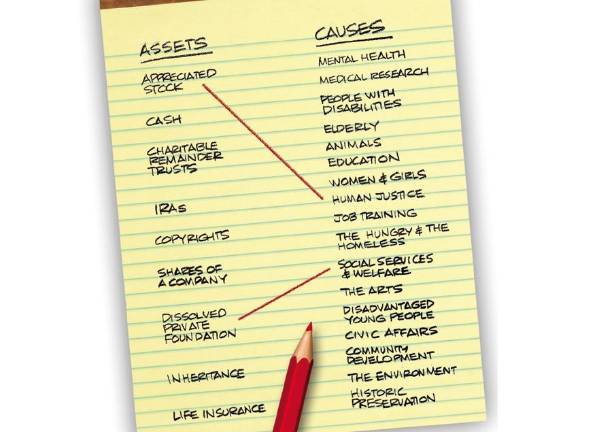

Many tax-savvy donors know that they don’t have to tap into their bank accounts to make meaningful charitable contributions. Instead, they use other assets that are just as valuable to nonprofits as cash.

Here are six ways you can support those in need this holiday season. And you don’t have to write a check for any of them:

1. Publicly Traded Securities. If you have money invested in the stock market, chances are you’ve had a good run recently. You might even be thinking about taking some of those gains out of the market to hedge against a downturn.

One way to manage the potential tax hit on gains is to donate some appreciated shares directly to a nonprofit. The charity will be able to use the money to help others – and you’ll be able to deduct the full, fair-market value as a charitable contribution without having to face a tax on the capital gains.

2. Individual Retirement Accounts. Retirees who are aged 70 and a half or older can make gifts directly to charity from their individual retirement accounts. In the process, they can exclude these gifts from their income taxes.

There are some exclusions – namely that you can’t get the tax benefit if you roll the money into a donor-advised fund or a private foundation. But your financial adviser or local community foundation can offer advice on how to make an IRA rollover gift.

3. Life Insurance. Many of us buy life insurance policies to help support spouses and children. But, in many cases, we outlive the need to provide that support when we pass.

If you have an unneeded life-insurance policy, you can choose to give it to a registered nonprofit and rest easy knowing that the proceeds will be used to help others.

You can even claim a charitable tax deduction, based on the policy’s current value, by transferring ownership to the nonprofit and making it the beneficiary during your lifetime. If you don’t need the deduction, you can choose to name the nonprofit as your beneficiary and the value of the policy will go to the nonprofit when you die.

Either way, you can give painlessly.

4. Art. Many New Yorkers have valuable assets sitting in plain sight.

Works of art don’t have to stay hidden from the world in your foyer or hanging over your fireplace. They can be donated to a charity — provided that the art is used to help further that charity’s mission. You can also arrange to have your art sold at auction with a charity being the recipient of the proceeds.

The tax rules around the donations of art are somewhat complex, but if you would like to turn valuable art into a force for social good, auction houses and community foundations can help get you started.

5. Real estate. For many of us, real estate is our most valuable asset – and property can be donated to the nonprofit of your choice, either for use or for sale.

Deeding real estate to a nonprofit can offer a number of advantages to both the donor and the recipient. Like with art and other valuables, you should consult a tax professional who can help you navigate the process.

6. Businesses and closely-held stock. Entrepreneurs who are looking to sell their businesses can consider making a tax-smart contribution by giving some or all of the proceeds of the sale to a nonprofit.

One Wisconsin foundation was recently given a cheese factory by one of its donors – and it used the sale of the business to secure $5.8 million for its operations. That’s a lot of cheddar.

While donating assets like stock or art isn’t quite as simple as writing a check, there are plenty of experts who can handle all of the heavy lifting for you. To get started, consult your local community foundation, such as The New York Community Trust, or your financial adviser.

Gay Young is VP for Donor Services at The New York Community Trust